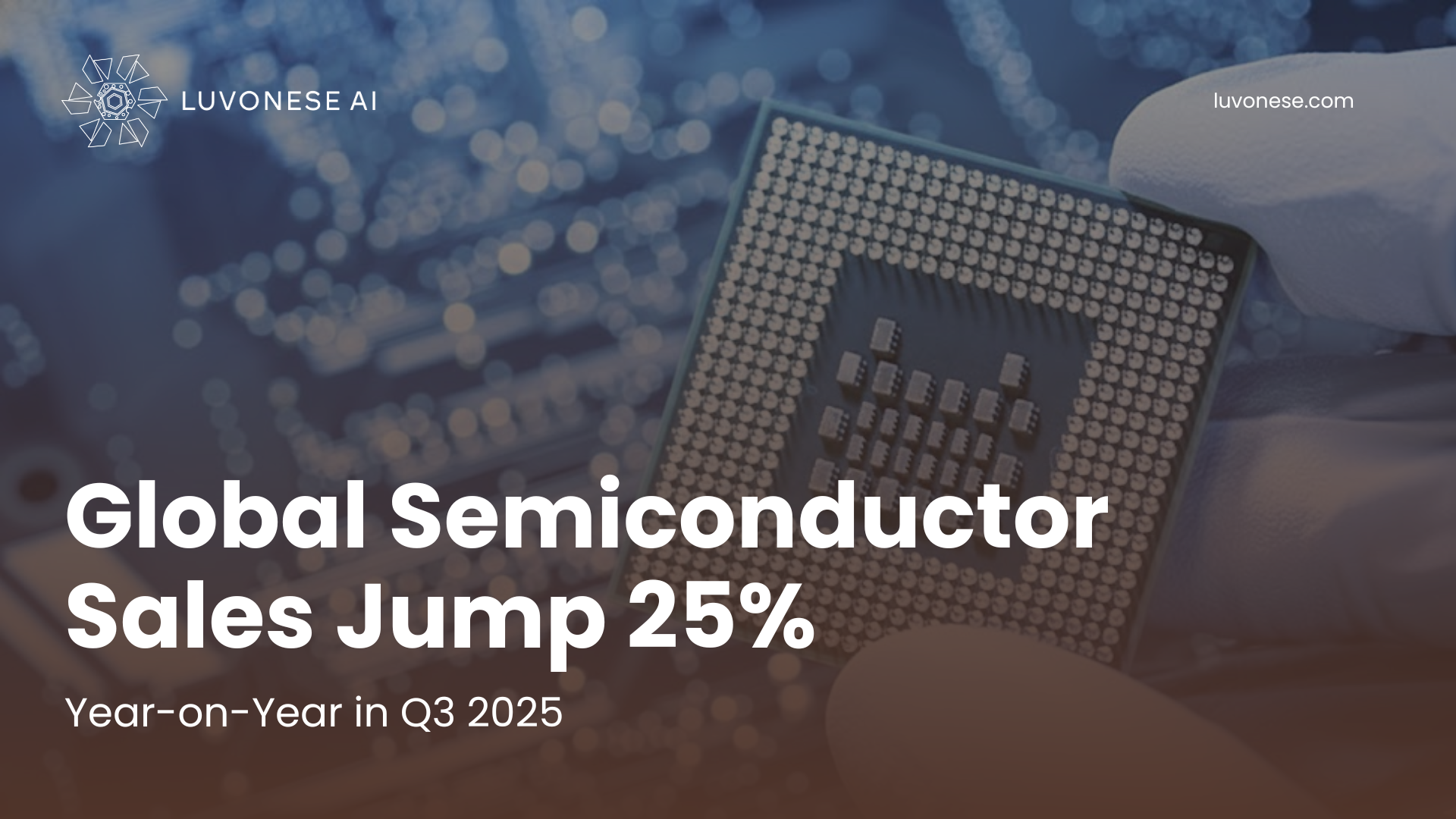

Strong Rebound in Global Chip Demand

The global semiconductor industry is witnessing a remarkable rebound.

According to the Semiconductor Industry Association (SIA), worldwide chip sales reached US$208.4 billion in the third quarter of 2025, a 15.8% increase from the previous quarter and a 25.1% year-on-year jump. This surge reflects renewed momentum in global technology demand, especially in AI hardware, data centers, and automotive electronics. Source: Semiconductor Industry Association

Key Growth Drivers: AI, Cloud, and Automotive

Analysts attribute the strong performance to the AI revolution and expanding cloud infrastructure investments across major economies. Demand for memory chips, processors, and high-bandwidth modules is growing, driven by AI servers and 5G-enabled devices.

Automotive electronics also contributed significantly, as electric vehicles (EVs) require up to 4 times as many chips as traditional cars.

Regional Performance Highlights

Asia-Pacific remained the world’s largest semiconductor market, accounting for over 60% of global sales, led by South Korea, Taiwan, Japan, and China. North America and Europe also posted double-digit growth, showing recovery in manufacturing and consumer electronics demand.

Industry Leaders Regain Momentum

Major chipmakers such as TSMC, Samsung Electronics, Intel, and Micron reported improved quarterly performance. AI-driven processors from NVIDIA and AMD continue to dominate the market. Semiconductor equipment makers also saw higher demand for lithography and packaging tools.

Supply Chain Normalization After Pandemic Shocks

After years of disruption due to the pandemic and geopolitical tensions, the global semiconductor supply chain is stabilizing. Lead times are shortening, inventories are healthy, and new fabs in the U.S., Japan, and Southeast Asia are boosting capacity.

The Policy and Geopolitical Context

Global semiconductor trade remains politically sensitive. Tensions between the U.S. and China persist, though recent talks indicate cautious optimism. Government programs like the U.S. CHIPS Act and the EU Chips Act aim to expand domestic production and reduce dependency on Asian supply chains. Related reading: Reuters – Global markets rally amid easing trade tensions

Implications for Emerging Economies

Emerging economies in Southeast Asia, including Indonesia, Malaysia, and Vietnam, stand to gain as tech firms diversify away from China. This could attract new investment in assembly, testing, and packaging facilities, creating jobs and fostering technology transfer.

Explore AI innovation opportunities at Luvonese.com

Outlook: Entering a New Semiconductor Supercycle

Experts believe the world is entering a new semiconductor supercycle powered by AI computing, 6G, and electric mobility. If growth continues, 2026 could mark the strongest year for chip demand in over a decade, boosting both manufacturers and global supply partners.